Advisory: Due to questions presented by commenter JP below, I am investigating this issue again. There is no question that Gospel for Asia’s actions violated U.S. law but it is unclear to me now if GFA violated India regulations. I thought the form I attached below required declarations of aggregate amounts of cash over $10,000. Due to information brought by JP, I am not so sure as of 12/24/15. The information I have gotten is conflicting and so I contacted Indian authorities and will be report the results back here when I get an answer. Thanks to JP for raising the questions. Stay tuned…

……………………………………………….

Original post:

While Gospel for Asia has admitted that GFA groups traveling together to India violated U.S. law by taking aggregate amounts of cash over $10,000 out of the U.S. without customs declaration, little has been said about Indian law.

Those who carried cash to India were told they had $4500 in an envelope which was to be given to officials at Believers’ Church headquarters in Kerala. The $4500 in cash was under the limit for an individual traveler. However, since whole groups traveling together transferred more than $10,000 from GFA-US to GFA-India, someone in the group should have declared the total amount.

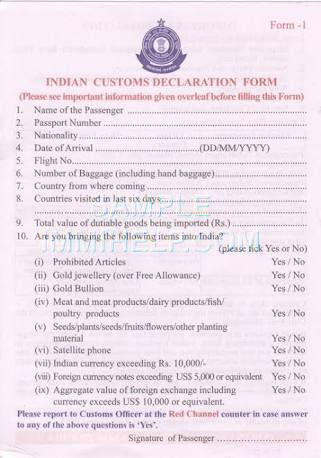

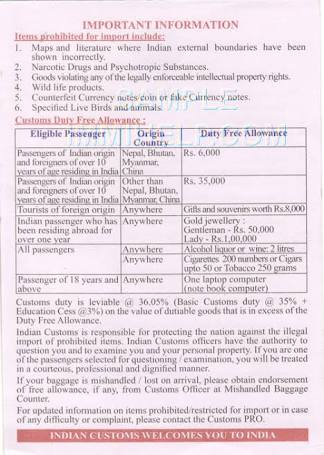

As it turns out, Indian law also requires declaration of cash if the total per transfer is over $10,000. This is clear on Indian customs forms which would have been filled out by those entering India. See the customs forms below and check item 10, subpoint ix.

It is hard to imagine that frequent India travelers like K.P. Yohannan and other senior GFA leaders had not seen this form.

It is hard to imagine that frequent India travelers like K.P. Yohannan and other senior GFA leaders had not seen this form.