In response to my series of articles on the changes taking place at Mercury One, I have been contacted by Mercury One donors. Two such donors, now former donors, agreed to comment anonymously about the changes in focus and donation allocation policy.

In response to my series of articles on the changes taking place at Mercury One, I have been contacted by Mercury One donors. Two such donors, now former donors, agreed to comment anonymously about the changes in focus and donation allocation policy.

Lack of Communication

One source of frustration for the former donors is the lack of communication from Mercury One. Without my posts, these donors would not have become aware that the changes had been made. The former donors said, “We did not receive any notification that restricted funds would be moved to a general fund.” Since the policy changes are buried on the websites, I can understand how donors would feel this way. If Mercury One is serious about going in this direction, they need to alert all donors and display the changes where they can be easily seen.

Reasons Questioned

Furthermore, the reason for the change did not ring true. “The focus of our giving is to support humanitarian initiatives and that is why we could align with and completely support The Nazarene Fund. The statement that Mercury One made concerning donations will be made to one fund because it allows them to give funds more quickly/easily just doesn’t make sense,” claimed the former donors. These individuals said Mercury One portrayed their response to past disasters as being rapid. The donors did not recall any mention of this limitation in the past.

History Museum

One of the reasons declared by the former donors for not giving relates to solicitations for a history museum by David Barton and Glenn Beck (see this post). They said, “We saw the history museum presentation by David and Glenn and will not be giving to this cause. We believe a donation to the museum fund does not effect change in the lives of hurting people but rather benefits Mercury One.”

Financial Statements

Now that donations are not being taken for the Nazarene Fund, the former donors would like a financial accounting. They said, “Another concern we have is that to date we have not received nor have we seen financial accounting on the Nazarene Fund.” In fact, there is very little reporting about funds received and spent on the websites. Donors might be more confident in Mercury One if fund balances were published on the website.

New Donation Allocation Policy

The former donors added, “Then we saw the posting of Mercury One’s new fund allocation policy, which causes us great concern. In our opinion that is not a decision to be made by them, that is a decision that donors should make. Since their organization has decided they will be in charge of placing our monies where they think best then we will not be giving to Mercury One. We are very concerned with the changes we have seen and can no longer support their initiatives.”

Overall, these donors expressed disappointment and confusion about the change of focus and the change in donation allocation.

I have reached out to Mercury One via their website, email and Twitter without response. Other donors who wish to share their experiences should feel free to contact me.

Tag: Mercury One

With Changing Focus, Mercury One No Longer Taking Restricted Fund Donations for Nazarene Fund

Since late 2015, one of the flagship projects of Mercury One has been the Nazarene Fund. On the Nazarene Fund website, the purpose of the fund is described:

Since late 2015, one of the flagship projects of Mercury One has been the Nazarene Fund. On the Nazarene Fund website, the purpose of the fund is described:

For several years, ISIS has invaded peaceful communities in the Middle East and painted the Nazarene symbol on the door of people they seek to convert, extort, or murder. While ISIS uses the Nazarene sign to symbolize death, we use the sign to symbolize life. Mercury One is a US based humanitarian aid and education non-profit organization that established and administers The Nazarene Fund. The Nazarene Fund aids in the restoration of Christians and other persecuted religious minorities and their communities who have been targeted by ISIS for their faith.

The Nazarene Fund was born out of Glenn Beck’s desire to help Christian refugees in ISIS held territories: Again, from the website:

In 2014, the Christian community in Syria and Iraq were facing the greatest calamity in its 2000 year history. The Islamic State (ISIS), exploded out Raqqa, Syria, the capital of its self-proclaimed Islamic State. In a lightning strike that surprised the world, ISIS forces captured Mosul, Iraq’s second largest city) and all of the nearby Nineveh plain – the traditional homeland of the region’s Christian Community. What followed was campaign of extortion, murder and displacement not only of the Christians but of other ethnoreligious minorities in the region. By 2015 a population of 3 million people was reduced to 300,000 – most of them displaced from their homes and fleeing to other countries.

In August of that year, Glenn Beck took the stage and the Restoring Unity rally in Birmingham, AL and declared the situation for what it was – genocide. Mercury One donors immediately responded and The Nazarene Fund was launched with a goal of rescuing 400 families.

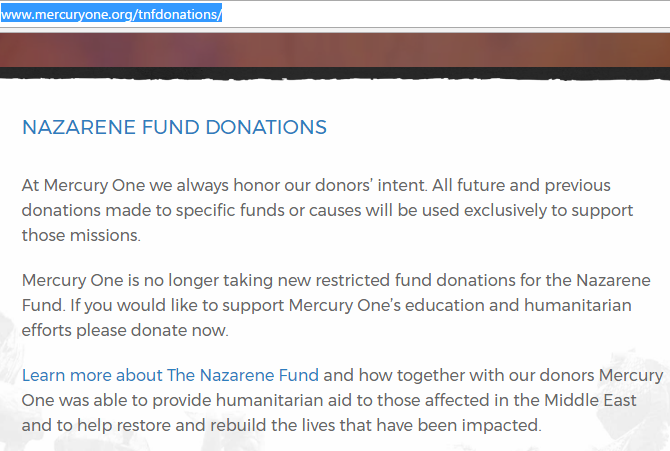

Recently, however, the focus of this fund has changed. First, consistent with my recent reports, donations to the Nazarene Fund are now going to benefit Mercury One generally. Mercury One doesn’t want to accept donations just for the Nazarene Fund. This message was recently added to the Mercury One page set up to accept donations to the Nazarene Fund:

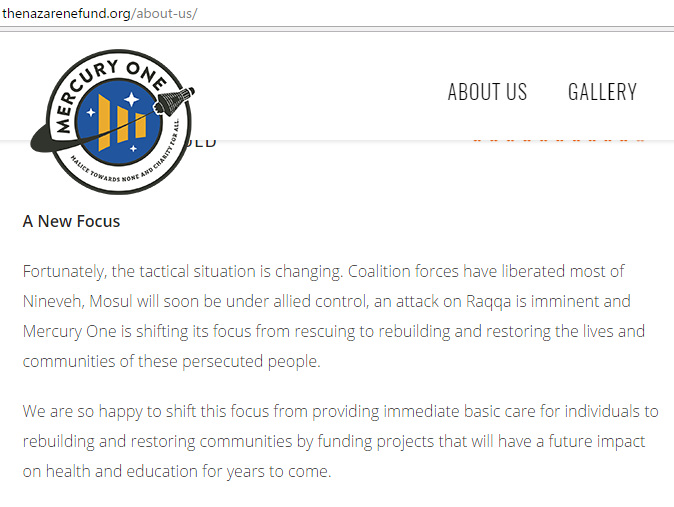

Second, Mercury One appears to be getting out of the refugee rescue business. According to the Nazarene Fund website, the need is not the same as it was in 2015.

Second, Mercury One appears to be getting out of the refugee rescue business. According to the Nazarene Fund website, the need is not the same as it was in 2015.

I am skeptical that the situation in Syria and elsewhere has improved to the degree implied here.

In any case, donors should be aware that Mercury One doesn’t want to accept restricted donations, even for the Nazarene Fund, and going forward, won’t be focusing on rescuing religious minority families.

Mercury One Clarifies How Donations Will Be Handled; Some Restricted Donations Allowed

Last week, Mercury One, founded by Glenn Beck, announced that all donations would be consolidated into one fund. In the past, Mercury One created various funds to accomplish specific goals. Donations to those funds (e.g., the Nazarene Fund for rescue of refugees) had to be spent on fund purposes. For instance, funds donated to rescue refugees could not be spent on purchasing historical artifacts.

At the time, I took a skeptical view of the changes. In my opinion, charities are more accountable when donors can specify how their funds are to be used. In practice, I think a charity should have an all purpose fund as well as specific funds for specific needs. The balances in these funds should be known to the public.

The Changes Were Changed

Apparently, somebody at Mercury One decided that the initial changes needed to be modified. Today, on the same blog post, the wording of the announcement has been changed. See below for the current announcement. The new material is in bold print:

Mercury One stands for doing the right thing and throughout our five-year history, Mercury One has done just that. While the needs change from season to season, the constant is that Mercury One has been there to respond to those in need. We know that you, our family of supporters and donors, are vital to our mission. One of the reasons we have had so much success with our humanitarian projects and The Nazarene Fund is because people like you have trusted us to be effective and make a real difference in people’s lives. Thank you!

If you have supported Mercury One in the past, or have followed our journey through Glenn Beck, you may know that for each need, we created a separate funding campaign so that we could allocate every penny of your gift to support each specific initiative. It has been amazing to see the outpouring of passion and support for these projects, but it also prohibited Mercury One from immediately distributing funds quickly when a new and urgent need arose.

Beginning in March 2017, Mercury One is streamlining the way we receive and allocate donations. Going forward, all gifts will go directly to Mercury One. We want to be able to respond more swiftly, and to do this, we are consolidating future gifts (unless otherwise specified) to a single account so we can be more nimble and react immediately when a need arises.

Donor intent is very important to us. Any restricted gift made to Mercury One has gone to support that specific cause. Mercury One has no intent of reallocating funds on any active funding campaign where the need still exists. For example, if you gave a restricted gift to Disaster Relief, to Veterans initiatives or to The Nazarene Fund, your gift will still be distributed to support that campaign.

At any point, if a donor sends a restricted gift, Mercury One will honor the intent of the gift. If there are no projects that would fit that gift, then Mercury One will communicate directly with the donor and at the direction of him/her will either redirect the gift to another project or return the gift.

We have been extremely honored to be able to partner with you, our donors, to make an impact in the world, whether it be to support disaster relief, veterans, those in crisis through our grant programs, or assisting Christians and other persecuted religious minorities in the Middle East. Our mission remains constant. We will continue to support humanitarian aid and education initiatives throughout our nation and the world. What is different, is that we will no longer raise funds for single projects nor for a General Fund to support daily operations. What stays the same is that Mercury One will continue to be conservative in our administrative spending and open with our hearts as we provide assistance to those in need.

We thank you for your continued support and partnership in restoring the human spirit.

Looks like a lawyer(s) got involved and crafted some language that is an improvement over the prior post. This approach seems more reasonable and transparent. Donors can submit gifts with instructions and if Mercury One can accommodate the donor’s intent, the charity will do so. If not, the money will be returned. All donations not otherwise designated will go to the general account for use as decided by the charity’s leaders.

Last I checked Mercury One still had a link to the Nazarene Fund. Donors who want to give to that fund should ask what those funds will support. Furthermore, one should not assume that donations made from the Nazarene Fund website will go toward that purpose. I still believe Mercury One should either remove that page or make it crystal clear (not buried in a blog post) on the front page that donations will only go to the purposes of the Nazarene Fund if the donor explicitly designates the gift for that purpose.

Mercury One Gave $104,000 to a Wall Builders Charity Which Had Its Tax Exempt Status Revoked

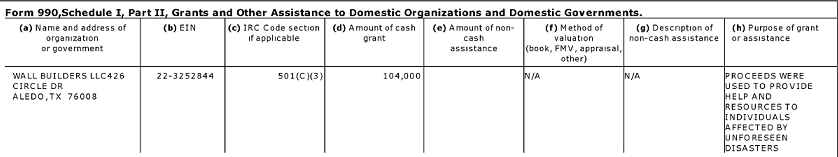

Last year and then again recently, I pointed out that the charity founded by Glenn Beck, Mercury One, gave David Barton’s Wallbuilders $204,000 over a two year period from 2013-2014. The grants are complicated by the fact that David Barton is chair of the board at Mercury One. When I reported this, I neglected to point out that the recipient organization for one of those grants ($104,000 in 2014) was stripped of tax exempt status in 2011 by the IRS for failing to submit yearly forms. Look at Mercury One’s 990 report for 2014 on this grant to Wall Builders:

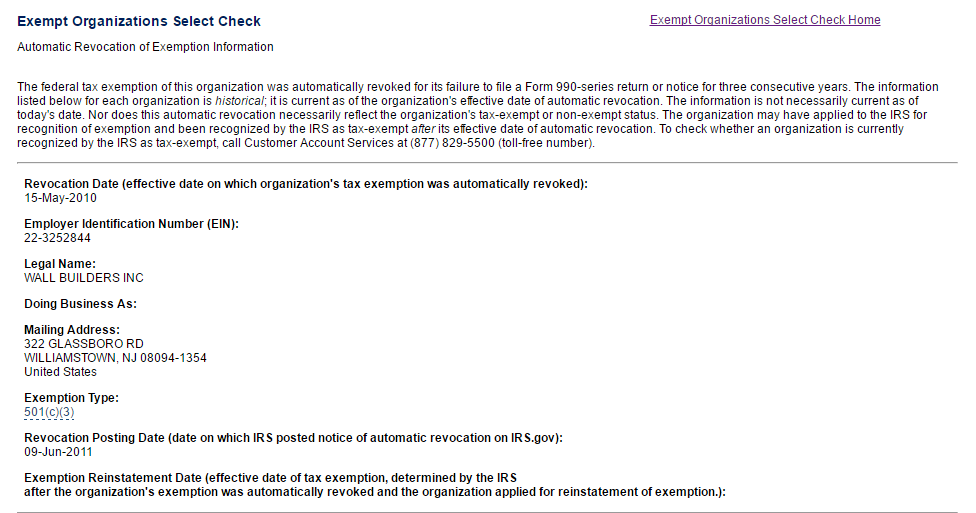

Notice the employer identification number: 22-3252844 (different than the number for Barton’s Wallbuilders Presentations). This is a federal identification number for a non-profit titled Wall Builders LLC. The address on the Mercury One’s website is the same as David Barton’s non-profit version of Wallbuilders Presentations. The first problem is that the gift is for “unforeseen disasters” which Wallbuilders has no obvious history of doing in a formal manner.

The second problem is that the grant was given to a Wallbuilders which was inactive. However, tracking the EIN at the IRS, I learned that this organization had its tax exempt status revoked in 2011.

Oddly, the address is in NJ* and not Texas as it says on the 990. In any case, this organization appears to be inactive and is unable to accept donations on a tax exempt basis.

Natural questions are: Where did those funds go and how were they used?

*322 Glassboro Road in Williamstown, NJ doesn’t appear to be an actual address, but may reflect the fact that Glassboro Road is US Route 322. It isn’t clear why the addresses are different. I asked Mercury One for clarification on the grant to this Wall Builders but did not get a response.

UPDATE: It is possible that the EIN is a mistake. Or perhaps Mercury One gave money to a Wall Builders in NJ (even though no one at the church knew about it when I called, there is one listed at St Matthews Baptist Church on Glassboro Road in Williamstown, NJ) but the wrong address was listed in the 990 form.

Mixed Donation Allocation Signals from Mercury One

Tuesday, I wrote about changes in the donation allocation at Mercury One. The Texas-based charity was founded by Glenn Beck with David Barton as the current chair of the board of directors. After years of allowing donors to focus their giving to a particular cause (e.g., disaster relief, helping refugees or even the general administration of the charity), Mercury One announced on their blog that all donations from now on would go into one fund:

Beginning in March 2017, Mercury One is streamlining the way we receive and allocate donations. Now, all gifts will go directly to Mercury One. We want to be able to respond more swiftly, and to do this, we are consolidating future gifts to a single account so we can be more nimble and react immediately when a need arises.

Despite this posting, Mercury One has not eliminated solicitations for giving to specific causes. For instance, when you land on the Mercury One website, at the very top of the page, there is a button that when clicked takes you to another website soliciting donations for “The Nazarene Fund.”

Up until recently, that fund has been dedicated to rescue and restoration of refugees. I asked Mercury One how much money was left in that fund but I did not get a reply.

Just a few days ago, a donor landing on Thenazarenefund.org and then scrolling toward the bottom of the page would find an image with Nazarene Fund t-shirts and a caption that reads “All proceeds go to the Nazarene Fund.”

Now, the same images are there but with a different caption:

While it is good that the caption has changed, it seems odd that the Nazarene Fund page is still active. Is there a dedicated Nazarene Fund or not? According to the new donation allocation policy, there is only one account. However, having a page advertising specific activities associated with a specific fund implies that donations to that page will go toward the purposes of that fund. If the new policy is truly in effect, then donations made from the Nazarene Fund page could actually go to some other purpose. The longer this stays up, the more likely it is that donors could question how donations given as a response to this solicitation have been used.