The American Association of Christian Counselors continues to indirectly respond to charges that the organization owned by Tim Clinton has become politicized. One focus of criticism has been AACC’s choice to feature one of President Trump’s attorney Jay Sekulow (see the AACC petition here). Yesterday, the AACC amended a promotional email by changing Jay Sekulow’s bio to include a statement about why he is speaking at a conference of counselors.

Compare this to the prior bio:

As a lawyer, Sekulow can speak to these legal issues. However, I don’t believe he could make a good case that his organization is on the cutting edge of mental health and counseling issues. Most of the important cases relating to what religious counselors can and can’t do have been litigated by Alliance Defending Freedom. A search of Sekulow’s American Center for Law and Justice doesn’t show any cases or news items involving counselors over the past two years, and that was a pro-life “sidewalk counselor” case. The ACLJ has focused on politics, opposition to abortion, and immigration.

“Getting involved in public policy discussions” is not the primary objection in the Change.org petition to remove politics from the AACC. The issue relates to one-sided partisan politics and the perception that the AACC has been silent in the face of statements and actions from the president which make the work of counselors more difficult. Sekulow isn’t known right now as an expert on the intersection of religious liberty and mental health. He is known as a defender of Trump’s actions and statements.

If Tim Clinton wanted to address these concerns, he could diversify the ideological offerings at the Conference. For instance, host a forum on healthcare and invite speakers of all ideologies to address counselors. Have single-payer advocates, Obama care advocates, and radical free market advocates address the paying customers. AACC right now is incredibly one-sided and heavily weighted with ideological mates of owner Tim Clinton.

See all articles regarding the American Association of Christian Counselors here: AACC

Tag: Jay Sekulow

The American Association of Christian Counselors Conference Features Court Evangelicals

The American Association of Christian Counselors hosts a regular conference in September which is often as much glitz as professional development. Contemporary Christian music artists sing (Mercy Me this year) and big name speakers speak (e.g., Eric Metaxas). There are also professional workshops and training sessions and materials to buy galore. Full disclosure, I have presented workshops at these conferences and once upon a time was on the AACC advisory board even though we rarely advised anyone about anything.

The American Association of Christian Counselors hosts a regular conference in September which is often as much glitz as professional development. Contemporary Christian music artists sing (Mercy Me this year) and big name speakers speak (e.g., Eric Metaxas). There are also professional workshops and training sessions and materials to buy galore. Full disclosure, I have presented workshops at these conferences and once upon a time was on the AACC advisory board even though we rarely advised anyone about anything.

This year’s conference looks almost like a meeting of President Trump’s court evangelicals and religious defense team. Eric Metaxas is a keynoter and the leaders just added Jack Graham and Jay Sekulow. AACC owner Tim Clinton is right in the middle of the court in the image to the right.

See below for the Trump court evangelicals just added:

I got this information from an AACC member who is tired of how politically focused AACC has become. Although I don’t think a mass exodus is coming, I am hearing rumblings that at least some counselors have dropped membership and others are considering it.

I hope there will be a session on healthcare reform and the persistent demand of Republicans to drop basic benefits like mental health coverage which many of the AACC members rely on for their livelihood and their clients need to get treatment. I also hope there is a session on narcissism and that it is well attended.

Perhaps, Trump’s new Communications Director Anthony Scaramucci can give a session on clean communication and dealing with the press. Court evangelicals would just eat that up.

Federal Tax Forms Show Why the Sekulow Family Business Should Be Investigated (UPDATED)

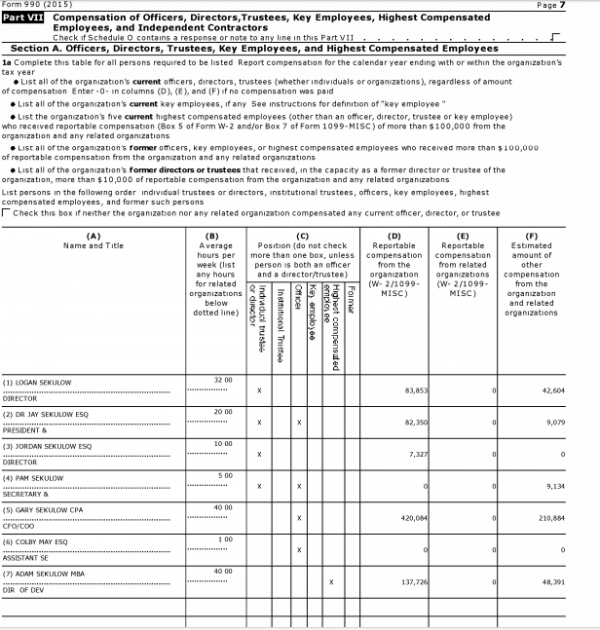

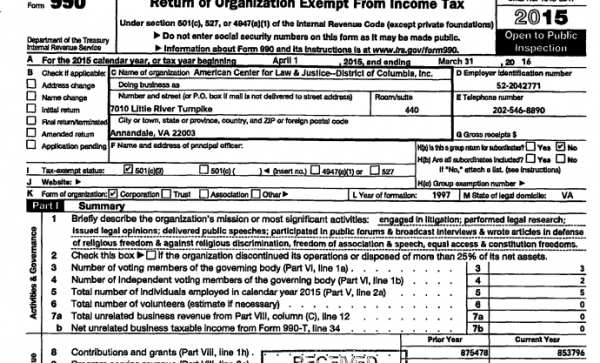

The UK Guardian reported yesterday that two state AG’s (NY and NC) will look into the finances of Trump lawyer Jay Sekulow and his fundraising charities. Examining the federal tax forms from Christian Advocates Serving Evangelism (2015 990), I can see why. Remember CASE is the nonprofit which serves as the fundraising organization for Sekulow’s American Center for Law and Justice, supposedly a religious liberty law firm.

According to the IRS, family relationship on the board of a nonprofit raise a red flag:

Irrespective of size, a governing board should include independent members and should not be dominated by employees or others who are not, by their very nature, independent individuals because of family or business relationships. The Internal Revenue Service reviews the board composition of charities to determine whether the board represents a broad public interest, and to identify the potential for insider transactions that could result in misuse of charitable assets.

It seems obvious that a nonprofit should not be organized like a closely held family company. Now look at the board of Sekulow’s CASE:

Perhaps the name of the organization should be changed to Christian Advocates Serving Sekulows.

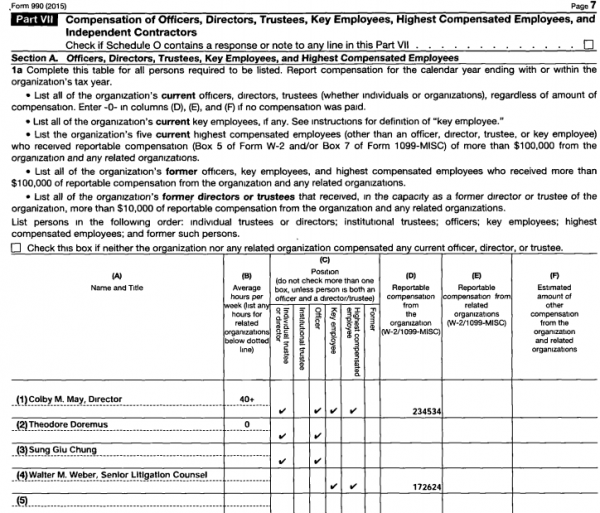

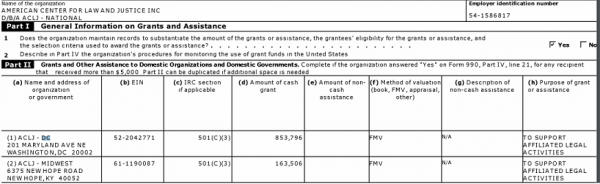

The only person on the board who is not named Sekulow is Colby May. However, he cannot be considered an independent board member because his income is dependent on grant money received from CASE/ACLJ. May runs the ACLJ’s DC affiliate which is completely funded by CASE/ACLJ. A review of ACLJ-DC’s 990 form shows May as the Director.

ACLJ-DC’s income was reported on the 2015 990 as $853,796.

As can be seen on ACLJ’s 2015 990, a grant of the exact same amount was given to ACLJ-DC.

I suspect CASE might have to provide more information to the AGs about how executive compensation was decided since none of the board members can be considered independent. Again, the IRS guidelines specify independence in setting compensation.

The Internal Revenue Service encourages a charity to rely on the rebuttable presumption test of section 4958 of the Internal Revenue Code and Treasury Regulation section 53.4958-6 when determining compensation of its executives. Under this test, compensation payments are presumed to be reasonable if the compensation arrangement is approved in advance by an authorized body composed entirely of individuals who do not have a conflict of interest with respect to the arrangement, the authorized body obtained and relied upon appropriate data as to comparability prior to making its determination, and the authorized body adequately documented the basis for its determination concurrently with making the determination.

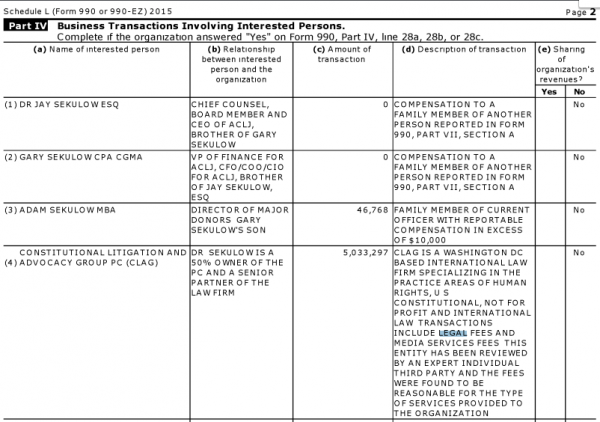

The CASE/ACLJ 990 form indicates the Sekulows and CASE/ACLJ engaged in four sizable mutual transactions as well as a major one involving a company half-owned by Jay Sekulow. See below:

Given the fact that none of the board members can be considered independent, how could this board prevent conflicts of interest as defined by the IRS?

B. Conflicts of interest. The directors of a charity owe it a duty of loyalty. The duty of loyalty requires a director to act in the interest of the charity rather than in the personal interest of the director or some other person or organization. In particular, the duty of loyalty requires a director to avoid conflicts of interest that are detrimental to the charity. Many charities have adopted a written conflict of interest policy to address potential conflicts of interest involving their directors, trustees, officers, and other employees. The Internal Revenue Service encourages a charity’s board of directors to adopt and regularly evaluate a written conflict of interest policy that requires directors and staff to act solely in the interests of the charity without regard for personal interests; includes written procedures for determining whether a relationship, financial interest, or business affiliation results in a conflict of interest; and prescribes a course of action in the event a conflict of interest is identified.

According to the 990, a third party expert reviewed the 5-million payment to Sekulow’s law firm and said it was all fine. I hope the AGs get to interview that third party. In the spirit of transparency, I call on Sekulow and company to disclose the identity of the expert and the basis on which the transaction is reasonable.

I hope the attention Sekulow is now getting will shine a light on the disgusting fund raising practices too many Christian charities use. Many such charities flaunt the very values and beliefs they claim to be upholding.

The Guardian Finds Skeletons in Trump Lawyer Jay Sekulow's Closet

I hope you go read this article by the Guardian on Jay Sekulow’s fund raising tactics. I had been aware of the massive amounts of money he has raised through fear mongering but I didn’t know about the actual tactics. This is obscene.

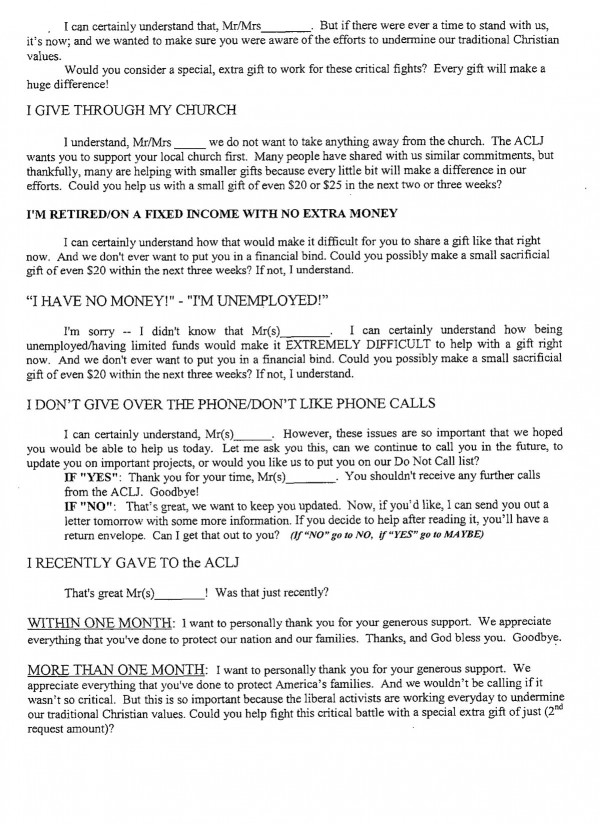

Sekulow has a company that manipulates Christians into giving money they can’t afford to give. Reminds me of K-LOVE. Here is a script:

I hope reporting like this helps dry up the money flow to these people. Most charities of this size simply don’t need your money.