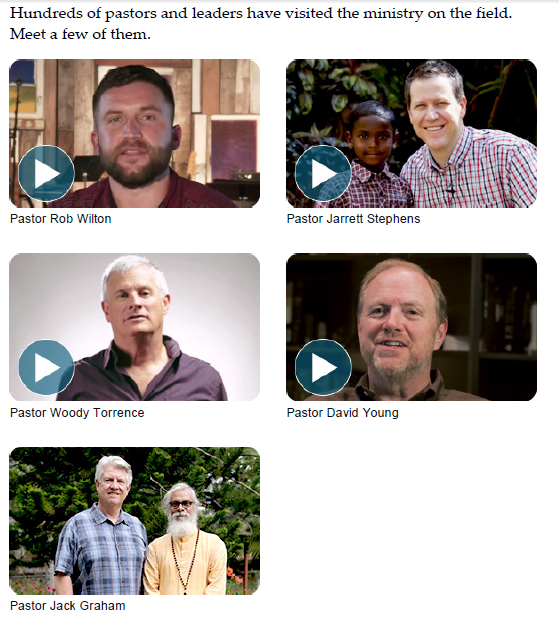

Once upon a time Prestonwood Baptist Church’s lead pastor Jack Graham endorsed K.P. Yohannan and Gospel for Asia. Now those endorsement pics and videos are missing. Other pastors who came to GFA via Graham (e.g., Rob Wilton) also are missing.

The current page is here.

As of about week ago, the bottom of the page looked like this:

Prestonwood Baptist Church has not responded to requests for comment about their current stance toward GFA.

Tag: Believers’ Church

Letter From a Former Gospel for Asia Donor Asking GFA Leaders to Repent

A reader who wishes to remain anonymous gave nearly $90,000 to Gospel for Asia over the last four years (click to view redacted giving history). Recently, he evaluated his decision and stopped giving to GFA. Feeling burdened for the work GFA claims to do, the individual wrote this letter to GFA. I have the person’s permission to publish it and hope it will stimulate reflection at GFA and among remaining GFA supporters.

I’ve seen this coming from the beginning months ago, but I’m now more prayerfully convinced than ever that the Lord will continue to slowly, methodically, and systematically dismantle GFA *unless* there is full and complete repentance from KP and top leadership. What does this mean exactly? What *specific* actions does KP have to take to stop God’s increasing righteous wrath? It means KP will have to A) sell ALL the ‘for profit business’ stuff which was so deceptively and fraudulently acquired with donor funds, and start using this money from the sales and all other donated funds specifically for its donor-intended purposes precisely as advertised on the GFA websites, and B) no more hoarding massive cash reserves in banks for accumulating interest but send the vast majority of it to the mission field. It’s hundreds of millions of dollars which was donated for and belongs to the Lord’s work!

Also, no more false advertising, including, for example, $35/mo BOH child support when it’s really more like $10 or less being spent per child. So many more kids could have been impacted through the program. With dynamic financial growth in recent years, GFA has also had enough money to support at least 50,000 missionaries, but sadly, KP chose to support only 14,000 instead. The main focus is not on supporting missions but his denomination Believer’s Church of which he is the head, archbishop, titled the Metropolitan, “His Grace or His Eminence the Most Reverend” Dr. KP Yohannan. In fact, KP has a B.A. and the doctorate is only honorary and the religious title of archbishop has been ruled “invalid” because the two bishops from the Church of North India (CNI) who conducted KP’s ordination without Church consent were dismissed from the Church for doing so.

The Lord’s patience and mercy are being tried to the maximum. This unrepentance mocks the Lord. If KP and his wife and son as well as top leadership just continue to try to wait it out and “weather the storm” and tinker a little here and there with a few more relatively minor changes without dealing with the heart of the problem outlined above, then the bleeding will continue and the damage will not cease. KP cannot continue to mock and try God by keeping the massive palatial state-of-the-art hospitals, posh private schools, agricultural plantation, etc., all bought with donor money rather than having that money sent to save lost perishing souls and help the needy. I believe it will be very much like Moses and the Pharoah, and the “plagues” will not stop for KP but the Lord will continue to increase the pressure and it will just get worse and worse unless and until KP truly repents which means DRASTIC action as outlined above. If KP will just do these TWO things (above), then it will make the biggest difference in the world in God’s eyes and GFA may be saved rather than steadily and eventually become just a shadow, a skeleton of what it once was. Precious time has been lost. Time is of the essence now. Action must be taken quickly and decisively, and not to save face or personal reputation, but for the sake of the lost.

There is one more secondary but also important thing that must be changed both in the GFA offices and in Believer’s Church in Asia. The Lord did not appoint KP to a position of higher authority and power or to establish a denomination under his own name sustained by donor funds, nor to bribe others to appoint him to the title. Nor was this done with donor knowledge or consent. God appoints his shepherds to be godly, lowly and meek, yet wise spiritual protectors and guides. Not corrupt, lying, hypocritical, glory-seeking, and foolish. There are many who would now argue that even if KP once had an anointing, he has disqualified himself from the ministry through his many serious immoral and potentially criminal actions, becoming a wolf among the sheep. What’s more, God does not acknowledge so-called “spiritual leaders” seeking Pharisee-like admiration & reverence and power & authority for themselves, these so-called “right reverend fathers in God,” archbishops, or “venerable archdeacons”, whether they imitate Eastern Orthodox or any other man-made ordinances, including Hindu-like pagan practices like praying around a metal symbol or icon as BC members do. Truly, truly no. No, indeed, Apostle Paul knew nothing of these mere inventions of man. They are an abomination to the Lord. Such idolatry must not be practiced, and such a position of superiority is not to be given even to pastors and teachers, or to the wealthy and esteemed among believers, NO, but to servants, ay, and to slaves. “But Jesus called them to Himself and said, ‘You know that the rulers of the Gentiles lord it over them, and their great men exercise authority over them. It is not this way among you, but whoever wishes to become great among you shall be your servant, and whoever wishes to be first among you shall be your slave.'” (Matthew 20:26-27).

But KP Yohannan has clearly and blatantly shown he wants to bypass all this and be venerated here on earth rather than wait for reward in heaven. He usurps the honour and authority that belongs only to Christ by having people bow to him and kiss his ring. Apostle Peter did not allow himself to be bowed to (Acts 10:25-26). Not even the angels allow themselves to be bowed to (Revelation 22:8-10).

But for those of us who wish to be servants of the gospel of Jesus Christ and not masters of special position and power or protestant popes of church denominations to receive the veneration of man which only Jesus the Head of the Church Himself has a right to: “Whatsoever ye do, do it heartily, as to the Lord, and not unto men; knowing that of the Lord ye shall receive the reward of the inheritance: for ye serve the Lord Christ.”

This is my third and final warning. I hope it will be heeded for the sake of GFA staff and for the sake of the lost in Asia — the good GFA work that some of the donor money is used for. Otherwise, if the Lord’s warnings continue to be ignored, then GFA will continue to go down. Our Lord will not tolerate being tried or mocked by disobedience and will reveal His power in even more awesome and frightening ways as He did with Israelites who warning after warning simply refused to repent. Our Lord loves KP and GFA workers too much to want to let this evil destroy GFA. Please KP, in the name of the Living God, for your own blessed sake and everyone else involved, I humbly desperately beg you, repent! genuinely REPENT!!

Interested readers, what do you think of these conditions? I suspect former staff might weigh in as well.

Discuss…

The Ownership of Gospel for Asia's Rubber Plantation Under Investigation by Indian Government

According to The Times of India, Gospel for Asia in India is being investigated by the Indian government in relation to GFA’s claim to own Cheruvally Estate, a working rubber plantation. GFA claims to have a clear deed but the government claims that the plantation should not have been sold to GFA by the former owner Harrisons Malayalam.

The special office to deal with Harrisons Malayalam Ltd cases has already issued orders to take over 38,051 acres currently held by HML and other private players who bought land from the company.

This includes 29,185 acres currently held by HML, 1,665 acres of Boyce estate, 2,700 acres of Ambanad estate, 2,263 acres of Cheruvally estate held by Gospel for Asia, 206 acres held by Ria Resorts and Properties and 450 acres of Goodampara estate held by MMJ Plantations. (emphasis added)

If GFA was a party to a fraudulent deed, the managing trustee of Gospel for Asia and Believers’ Church might face jail time. The managing trustee is K.P. Yohannan.

You can read more about GFA’s purchase of Cheruvally Estate on the GFA website.

After Lengthy Investigation, Grace Church Amarillo Stops Support for Gospel for Asia

In an emotional explanation to his church on December 16, Grace Church’s (Calvary Chapel Amarillo) pastor Bill Gehm disclosed that the church will no longer support Gospel for Asia. Gehm repented to his church for asking them to support GFA for 17 years. Pastor Gehm personally stopped supporting GFA and advised the congregation to stop supporting GFA. Gehm expressed that his money had not been spent the way he believed it was being spent.

The 18 minute video is an extraordinary message disclosing that he has spent many hours investigating GFA, including several hours with GFA COO David Carroll. Gehm specifically prayed for K.P. Yohannan.

For those interested in this issue, this is must see TV. I appreciate the serious tone with which Pastor Gehm approached the magnitude of the problem.

What Gospel for Asia/Believers' Church Spends on Bridge of Hope: An Update

David Carroll, Gospel for Asia’s COO, told World magazine that Gospel for Asia’s field partner in Asia (i.e., Believers’ Church) requires $33 million to take care of 78,000 children via the Bridge of Hope program. Here’s the quote:

Carroll offered statistics, including that GFA’s field partners in India and elsewhere in southern Asia support some 14,000 national missionaries at a cost of approximately $30 million a year. He added that the ministry provides for 78,000 children through GFA’s “Bridge of Hope” program, which requires another $33 million a year…

After that article came out, I compared David Carroll’s statement to conflicting statements by K.P. Yohannan and Believers’ Church’s own budgets for Bridge of Hope centers. The costs stated by Yohannan to sources in India were about a third or less than Carroll’s numbers.

As an update, I want to provide another authoritative sources which contradicts Carroll’s statement to World. During the week of January 4-11, 2015, Believers’ Church conducted their General Assembly in India. As a means of commemorating the event, the church published a collection of letters from government officials and a report of how the various BC ministries were doing. One page dealt with the Bridge of Hope program and proclaimed that the program spent “approximately Rs 70 crore” on 72,000 children. See below:

See the sentence in the yellow oval above (click on the picture to enlarge it). In January 2015, Believers’ Church said it spent Rs 70 crore (about $11 million USD) to fund a program serving 72,000 children. This works out to nearly $13/month/child. This is dramatically less than David Carroll told World. It is also much less than the $35/month/child GFA tells American donors is needed for sponsorship.

The ECFA report made it clear that GFA had not honored the pledge to send 100% of donor support to the field. In India, Believers’ Church owns over 100 schools and several state of the art hospitals. Is that where the extra donations ($22/month/child) have gone?