One former donor to Gospel for Asia has been so concerned about being a good steward that the donor tried to get payment stopped on a credit card used to send payments to GFA. It appears that the card company has been challenging GFA over those charges.

The donor does not want to be identified but has provided evidence of the charges.

The donor disputed the last three charges to the card and this week was credited for one month’s charges. The card company is still disputing the other charges.

According to my source, a representative at the company said GFA did not provide documentation to verify that funds were used for the designated purpose. Instead, GFA gave the card company a letter sent to the card holder in 2014. The letter reminded the card holder that a recurrent payment had been set up to support GFA causes.

The representative told my source that a second disputed case had been filed by another donor against GFA this week.

Category: K.P. Yohannan

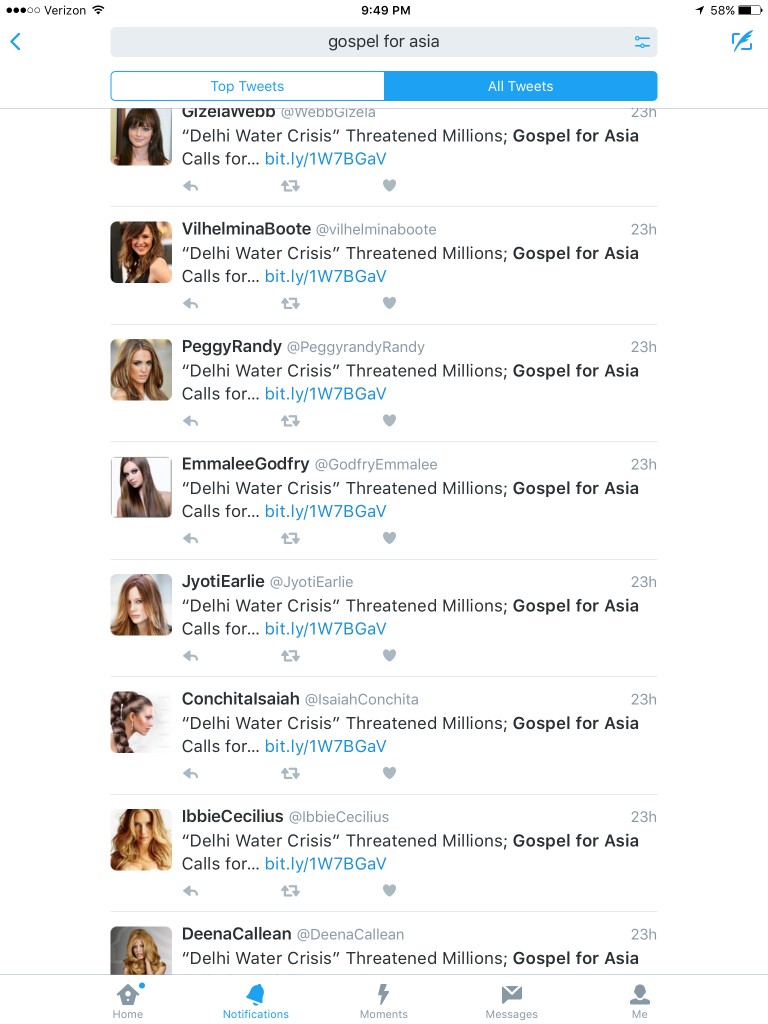

Gospel for Asia's Christian Astroturf

In the past, Gospel for Asia has spent donor money on “reputation management” — using fake accounts to flood social media with positive information about GFA. It appears they are at it again. On twitter, the image below is the result of a search for GFA.

The glam photos, odd name combos and exact same message give away the spam. I am not sure of the value of these tweets since the accounts are quite small. In any case, someone is reporting lots of social media traffic which is ultimately fake.

The following accounts also appear to be fake.

The format is all the same (there are dozens of these) and they all hope to see me around. I doubt it. They link to blogs which are either fake addresses or to blogs which have no entries.

We know GFA has contracted with Reputation Management Consultants in the past to shore up GFA’s image. Instead of a grassroots uprising of donors defending GFA, it appears that more donor money is going to Christian astroturf.

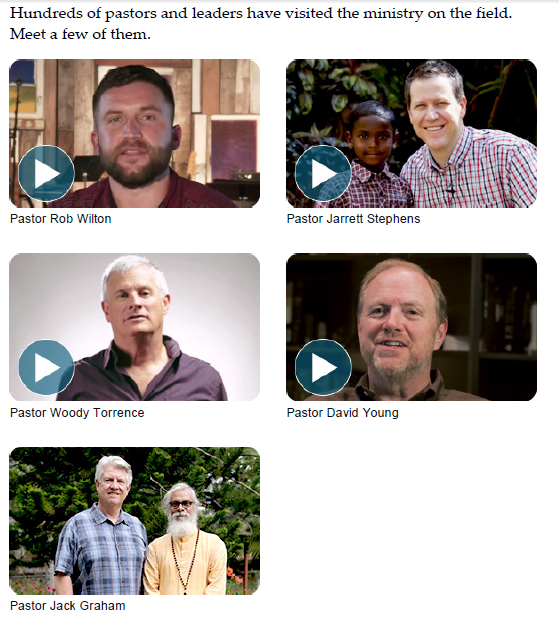

More Gospel for Asia Endorsements Missing

Once upon a time Prestonwood Baptist Church’s lead pastor Jack Graham endorsed K.P. Yohannan and Gospel for Asia. Now those endorsement pics and videos are missing. Other pastors who came to GFA via Graham (e.g., Rob Wilton) also are missing.

The current page is here.

As of about week ago, the bottom of the page looked like this:

Prestonwood Baptist Church has not responded to requests for comment about their current stance toward GFA.

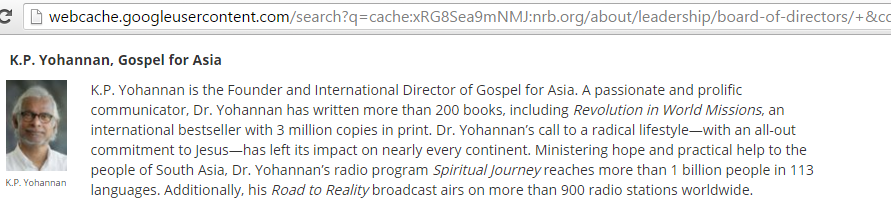

Gospel for Asia No Longer Member of National Religious Broadcasters; K.P. Yohannan No Longer on NRB Board

Acting on a tip, I contacted the National Religious Broadcasters to ask if Gospel for Asia had been dropped from membership in the organization. I also asked if K.P. Yohannan was still a part of the 2018 board class.

Spokesman Kenneth Chan provided the following statement:

GFA is no longer a member of NRB. That part of the website was outdated and now fixed.

Mr. Chan provided no answer to my question about why GFA isn’t a member.

At one time, the organization was a member and Yohannan was a member of the 2018 board class which means he was just re-elected in 2015 and was slated to serve until 2018. He had also been a member of the board class of 2015.

The member profile is still on the NRB website, but a link to it is missing in the directory of organizations.

Although no reason was given, and GFA did not respond to an inquiry, it seems obvious that the move is most likely in response to the ongoing scandal enveloping the second largest mission group in the nation.

Indian Media Taking Up the Gospel for Asia Scandal

Slowly but surely, the Indian press is taking a look at the Gospel for Asia scandal. I have been contacted in the past week by an Indian journalist for information. Various stories have appeared on Indian websites. For instance, see below:

Matters India: Indian Pentecostal leader accused of misdirecting donations

UCANews (Catholic news): Indian-American charged with running fraudulent charity

American Bazaar (American website devoted to Indian news): Indian-American Missionary Accused of Funneling Hundreds of Millions of Dollars for Personal Use

Readers may leave additional links in the comments.