Advisory: Due to questions presented by commenter JP below, I am investigating this issue again. There is no question that Gospel for Asia’s actions violated U.S. law but it is unclear to me now if GFA violated India regulations. I thought the form I attached below required declarations of aggregate amounts of cash over $10,000. Due to information brought by JP, I am not so sure as of 12/24/15. The information I have gotten is conflicting and so I contacted Indian authorities and will be report the results back here when I get an answer. Thanks to JP for raising the questions. Stay tuned…

……………………………………………….

Original post:

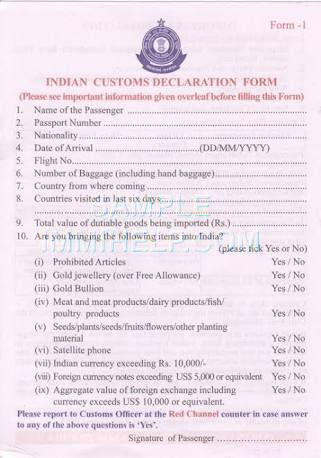

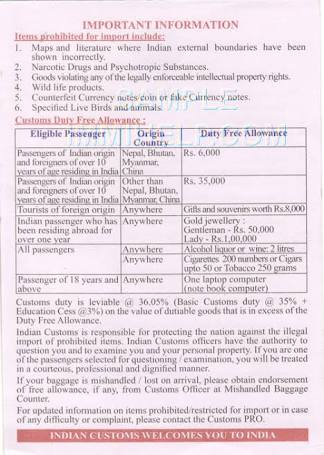

While Gospel for Asia has admitted that GFA groups traveling together to India violated U.S. law by taking aggregate amounts of cash over $10,000 out of the U.S. without customs declaration, little has been said about Indian law.

Those who carried cash to India were told they had $4500 in an envelope which was to be given to officials at Believers’ Church headquarters in Kerala. The $4500 in cash was under the limit for an individual traveler. However, since whole groups traveling together transferred more than $10,000 from GFA-US to GFA-India, someone in the group should have declared the total amount.

As it turns out, Indian law also requires declaration of cash if the total per transfer is over $10,000. This is clear on Indian customs forms which would have been filled out by those entering India. See the customs forms below and check item 10, subpoint ix.

It is hard to imagine that frequent India travelers like K.P. Yohannan and other senior GFA leaders had not seen this form.

It is hard to imagine that frequent India travelers like K.P. Yohannan and other senior GFA leaders had not seen this form.

Category: David Carroll

Christianity Today On the Release of Gayle Erwin's and ECFA's Reports on Gospel for Asia

Bob Smietana at Christianity Today has put together a great summary of both the ECFA and Gayle Erwin reports to the board of Gospel for Asia. I encourage readers to go read it.

Here are some highlights:

In the article, Smietana pointed out the misleading nature of GFA leaders’ communications with the ECFA, GFA board, and the donors.

From the article:

Despite running a ministry that collects hundreds of millions in donations, Yohannan appeared to be unaware of the basics of nonprofit management.

GFA appears to be cultivating a narrative which casts Yohannan and COO David Carroll as incompetent rather than deceptive.

In a first, Yohannan sent a note to Smietana saying he appreciated the GFA review. As I noted in my post about Gayle Erwin’s report, Yohannan did not appreciate Erwin’s candid report.

A scapegoat for Yohannan in his note to Smietana is the rapid growth of GFA. Remember, GFA was a charter member of the Evangelical Council for Financial Accountability. GFA has had access to ECFA materials and guidance for well over 30 years. GFA’s website is full of promises to be financially astute, still using the Independent Charities of America Seal. Blaming their growth is another way of passing the buck.

Smietana pointed out that Gayle Erwin was told to rewrite his report on the allegations from the GFA Diaspora.

Smietana pointed out that David Carroll told CBS 11News Dallas that GFA was kicked out of ECFA over minor infractions. Smietana contrasted that claim with the serious problems highlighted by the ECFA report.

Go take a look, there is much more.

The Other Gospel for Asia Report K.P. Yohannan Did Not Want Anyone to Read

On December 2, former Gospel for Asia board member Gayle Erwin released the results of ECFA’s investigation into GFA’s violations of ECFA standards. At the same, Erwin also disclosed another aspect of GFA’s actions which is as disturbing as the ECFA report. First some background.

In June 2014, a group of former GFA staff members approached GFA’s leadership with five major concerns (see the GFA Diaspora site for a detailed history and list of concerns). Eventually, GFA’s board appointed long-time board member Gayle Erwin to conduct an investigation into the five allegations. In early March, Erwin submitted his report. Erwin found that most of the allegations had some substance and should be addressed. According to Erwin, GFA’s CEO and founder K.P. Yohannan was furious when he read Erwin’s report. Erwin described his recollection of the scene in an undated letter to the GFA Diaspora former staff group.

When I first presented the conclusions of my investigation to KP [Yohannan] (with David Carroll present) KP glanced at it, declared that he was a speed reader, and began what I will simply call an ugly scene filled with brutal expressions I don’t wish to repeat, except for one I will reveal later. I presented this same report to the Board of GFA. The ugly scene began again with similar brutality. My recommendation was that we confess, make restitution and change, and that I be granted permission to meet with you. The board rejected my findings and I was instructed to write the public report which was sent to you. Although the board was very pleased with the report, the agony of having written it has not left me.

Erwin also wrote a letter, dated March 17, to Yohannan in which he described Yohannan’s reaction:

I [Erwin] approached this situation in as honest and ethical manner as possible. Never did I hint to you [Yohannan] or anyone else what my findings were until I presented them to you in your office in the presence of David Carroll. I kept isolated from any attempt to present “our side” from anyone including you. Obviously you were not happy. I think you expected me to completely exonerate you and GFA. You more than lost your temper that afternoon. You exhibited a serious mental failure in your paranoia and irrationality. Your response was and still is a “scorched-earth” approach that is willing to burn down anyone and anything in the way of your own conclusions and status.

Erwin then rewrote the report. It was sent to the GFA Diaspora in a letter dated March 26, 2015. It is much shorter than Erwin’s original report and denied the allegations. With board awareness of the original report, Erwin wrote

In response to your letter of September 3, 2014, after many hours of investigation, intense prayer and examination of heart, we are broken-hearted and repentant that we damaged by our actions and attitudes any believer for whom we had responsibility by relationship. We have proposed, and still do, to go wherever we need to and do all within our power to apologize and seek forgiveness and healing with anyone and everyone on your list who may have suffered damage of spirit or heart from us. That individual contact has not been afforded to us by you, which, to us, neutralizes your accusations. But, we have done all we can do about the past until freedom is granted to us.

We have, from the beginning, made our new headquarters fully open to the community and have purposely served the community. We do not have church services in our chapel. We do encourage workers to go to local churches, be a part of them and receive any and all counseling from the local pastors and churches, except in very rare cases. Our gates are left open and visitors are welcomed and shown whatever they wish to see and questions are answered. We are, indeed, a community and fellowship, but no one would be able to find evidence of being a cult.Your final combined declaration about the structure and presentation of the personnel and headquarters in India, coupled only with a photo was misapplied about an ordination service whose presentation is required by the state for proof of ordination, otherwise one could be imprisoned for doing religious activities limited to the ordained. Other parts of that accusation could not be verified in the manner in which you made them, and have been dropped as worth considering.

Consequently, we feel that your other accusations are without foundation in terms of the fulfilling of our call to enlarge the Kingdom of God. We also feel that your demand that we gather the boards of the USA and Canada to meet with you in order to escape your threats is excessive, impractical and counter to the commitment of our time to getting the Gospel to those who have not heard. We do not intend to call for or participate in such a board meeting.

Therefore, we send this as our final report and communication and now consider the matter closed.

Gayle

In behalf of the Board of Gospel for Asia

Then on December 1, Erwin sent a letter of apology to the GFA Diaspora and provided the original quashed report. Erwin expressed sorrow and provided a brief rationale for re-writing the report.

I apologize to you for the report that was sent to you. Some of the report I wrote with the hope that it would become true and that I was making progress in some intense mental and spiritual combat with KP. That hope was dashed. The financial part that I dismissed, I later learned was true. Please forgive me.

Thus, Erwin suppressed the actual results of his investigation because CEO Yohannan was angry. The GFA board (which at the time included Skip Heitzig, Chuck Zink, Bob Felder, Yohannan, and Yohannan’s wife and son) went along with this deception.

The original report includes evidence that the Diaspora’s allegations had merit. Below are some excerpts:

POINT #1 – Absolute Obedience

Here are my findings relative to the question of obedience/submission as expressed in point #1: Requirement of absolute submission and obedience without questioning to GFA leadership.

A. This complaint appears to be true and is the main source of the problem. If this were to be settled, we would be almost finished with the problem. B. The evidence for this is overwhelming. First there was tacit admission that this is true and the defense was not to refute the charge but to cast doubt on the claimant’s truthfulness or motive.

……

Point #2 Shunning

However you define shunning–isolating, ignoring, quarantining—this appears to have actually happened, often without explanation, in order to keep “poison” from other workers. In some cases, this kept people from the only fellowship they had. Along with required obedience without questioning or praying, this was a great source of pain for some and fueled some complaints we have facing us.

……

Point #3 Misrepresentation of the Use of Contributions

This is not true. A case could be made for use of contributions for more than what was stated, but not wrongly used. Plus, K. P. says that 60% of the needs are now met from the field—they are that close to independence—so some things are domestically funded that may appear to those at a distance as misuse. I considered this a speculative claim with no true basis. (This now appears to be true.)

Erwin added in his apology that he now believes the allegation of misrepresentation of contributions (“the financial part”) is true.

Point #4 Cultism

Developing a cult or cultish mentality is a claim for which evidence exists.

A. Obedience and shunning are tactics that every cult uses.

B. Isolation. When KP decided to build the compound in Wills Point, Texas, the reasoning was not that the Carrollton, Texas location was inadequate, but that it would save money (from $1 million to $3 million a year) and, when I asked if disrupting the lives of the workers was a consideration, the answer was “We will find out who is committed.” Those were the only two reasons I heard given.

C. Spurious demands. Head covering is expected of all the girls though “it is not required.” It is taught by KP because he firmly believes it, although the 1 Corinthians 11 recording of Paul makes it clear that a girl’s hair is her covering and that, if anyone is contentious, “We have no such custom.” You could expect any girl who chooses not to add a cover to be under heavy pressure and have to constantly explain her choice—a great difficulty when the interpretation is questionable.

D. Praying is discouraged about decisions concerning their personal life. A common cult tactic. This is ironic since prayer is such an emphasis.

E. Secrecy. These expectations are never listed in the advertising. Nor was the secrecy in which the compounds and practices in India ever admitted or explained. `

Point #5 Withholding Information About Organizational Structure

Adopting an Eastern Orthodox organizational style and clothing style without letting it be known in North America is true and represents a vulnerability that may be costly.

A. KP has taken upon himself the title of “Metropolitan,” a title in Orthodox circles equivalent to “Pope” in Catholic Churches.

B. Dramatic robes and long white cassocks are worn at church events by bishops and others in authority. The most dramatic robes are used in ordinations, they explain. The explanations for the most ornate robes and authority symbols is that these are necessary for ordinations so the government will recognize them as such, since to claim ordination falsely will subject you to jail. I have no evidence that this ornateness is necessary to validate ordination.

C. Two visits ago to India, as I was brought to the new headquarters, the first image I saw was a large stone “cathedral” building of British/European design. I was in shock for two reasons: First, the cost of something like that, copied from a failed system, could have sponsored many evangelists. My thought was, “How many souls did this cost us?” Second, why had I not heard of this before? Also, during a break, I wandered to a side room of the platform and read a book outlining service orders more from episcopal type churches than from evangelical ones. These old orders may provide a spectacle but they are borrowed from failed and failing systems.

D. In my last visit, on a Sunday, I was carefully kept from observing the service. It was a troubling moment.

E. Though admitting the Orthodox style and system, KP maintains that the theology remains evangelical.

Erwin finished his report with the following questions:

This concludes my observations and comments but leaves me with certain significant questions:

1. Why did all of this come as a surprise to me, a 30-year board member?

2. How can we apologize to our accusers without being self-serving?

3. Can anything be successfully changed to make our training systems free from traditions and more like the example and teaching of Jesus?

4. If no changes or apologies are made, how can we handle (or can we) the public relations disaster of the revelation of the Orthodox system to our largely evangelical supporters?

5. What is our role as a board?

6. Were any of these actions of GFA (KP) necessary for the success of GFA?

7. Were we not succeeding before the imposition of new systems?

8. Are there any surprises yet awaiting us?

Sincerely and Painfully Submitted, Gayle D. Erwin

There certainly have been more surprises.

Suppression of Information

Taking the two reports together (Erwin’s and ECFA’s), it is hard to escape the conclusion that CEO K.P. Yohannan and the GFA board have engaged in suppression of information material to donors and supporting churches. A trusted board member of 30 years (Erwin) discovered information he did not know but considered important and potentially damaging. This information was then suppressed and covered up. According to the ECFA report, much of GFA’s financial information was kept from the board. In the case of Erwin’s report, the board deliberately suppressed information important to donors and critical to their role of serving the public interest.

One former board member, Skip Heitzig, still seems to be engaged in damage control. Not long ago, he allowed a subordinate to write a letter about GFA that minimized the findings of both the ECFA and his former board colleague, Gayle Erwin. Heitzig’s assistant declared that no independent investigation had established wrongdoing on the part of GFA. This is an incredible claim given that Heitzig had access to ECFA’s report of 17 areas of concern leading to an ECFA board vote which found GFA in violation of five financial standards. Furthermore, now we know that Heitzig had access to Gayle Erwin’s report and sat on the GFA board which approved suppression of Erwin’s findings.

The suppression of Erwin’s report is, like so many aspects of the unraveling GFA story, truly scandalous. Donors, supporting churches, and the general public expect board members to look out for their interests and the interests of people served. It remains to be seen whether the GFA board will step up to those responsibilities.

Gospel for Asia and Bridge of Hope Funding: Who is Right – David Carroll or K.P. Yohannan?

In today’s World magazine article on Gospel for Asia, COO David Carroll made the following claims about program spending.

Carroll offered statistics, including that GFA’s field partners in India and elsewhere in southern Asia support some 14,000 national missionaries at a cost of approximately $30 million a year. He added that the ministry provides for 78,000 children through GFA’s “Bridge of Hope” program, which requires another $33 million a year, and constructs some 1,200 new churches a year at a cost of another $15 million annually.

Bridge of Hope

I want to focus on the Bridge of Hope claim. Carroll’s claim is consistent with what Gospel for Asia asks donors to give in order to sponsor a child ($35/month). However, in the past, GFA founder and CEO K.P. Yohannan has claimed it takes much less per child. In 2010, according to a New India Express article which cited Yohannan, the program required 30 crore (at the time equal to about $6.5 million USD) to provide for 60,000 children.

At present the Church spends Rs 30 crore annually for the education and uplift of 60,000 children through 525 centres. The Bridge of Hope project of the Believers Church provides free education, health care, nutritious food and school supplies for underprivileged children, irrespective of caste or creed.

This works out to $9/child/month. At the time, GFA was asking for $28/child/month in order to sponsor a child.

Then again in a 2012 interview on Surya television, Yohannan said it cost almost 40 crore (about $7.1 million USD) to care for 60,000 children. Yohannan said:

As for Believers’ Church and Cheruvally estate, donors specifically (1:18) have instructed us to establish an income producing entity (1:23), in the future for you to continue your work. Let me ask you, we spend almost 40 crore rupees to take care of 60,000 children – where does this money come from? Can we campaign to raise money all the time? We have to produce our income (1:43), that is what this is for, for that only.

Using the estimated exchange rates in 2012, as described by GFA and Believers’ Church leader Yohannan, the per month per child spending works out to just under $10/month. In June 2012, GFA was asking $35/month in order to support a child, the same as the current cost to a donor.

According to the public reports of spending in India (FC-6 forms), GFA spent $6.2 million USD on the “welfare of children” in the Indian fiscal year ending March 31, 2014. That works out to about 105/child/year or just under $9/child/month.

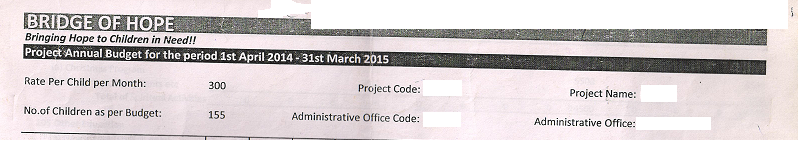

I have seen two budgets for Bridge of Hope centers in India, each for a different region of the country. I wrote about one budget earlier this year:

I have also seen GFA budget documents which tell a more surprising story.* The actual cost during fiscal year ending 2014 to support one child in a GFA Bridge of Hope center in India was just under INR 500 or around $8.20 per month per child. This paid for the administration of the program, food purchases, and all child services. In fact, the actual items given to each child (school supplies, clothes, hygiene supplies and gifts) only cost INR 140 per child or $2.20 per month.

In another region of the country, the per child expense was even less — 300 rupees per child per month, or just under $5 USD/child/month. In some areas of the country, children attend free public education and so the costs are less.

Even though this is dramatically less than what David Carroll told World magazine, it is closer to what K.P. Yohannan told Indian media.

A review of receipts for 2012 reveals that donors don’t contribute anywhere close to $33 million for Bridge of Hope related expenses.

Given GFA’s track record regarding public claims, it is reasonable to question what David Carroll told World. What would help is if GFA released some evidence for their claims. Show us the budgets, audited statements, etc. The ECFA said in the investigation report that many of GFA’s intial disclosures were not accurate and that they had to get necessary information from other sources, when the information should have come from GFA.

One analysis by former auditor Jason Watkins found that only 12% of funds given for Bridge of Hope was used for the program. With the discrepancies between what David Carroll and K.P. Yohannan told different public audiences, it is important for GFA to provide evidence and an explanation. With the budget figures and public reports in India, it even more important for donors to get answers about where those funds are going.

World Magazine on the Release of the ECFA Gospel for Asia Investigation Report

World’s Bill McCleery has an article today on the Evangelical Council for Financial Accountability’s Gospel for Asia investigation report released to me and the GFA Diaspora last week.

GFA COO David Carroll sounds more contrite than ever in this piece saying GFA leaders “owned” their mistakes and are sad and sorry that they “breached the confidence of our donors.” This is a long way from May 7 of this year when Carroll told me:

No, Gospel for Asia has not violated the law.

When you first contacted us, I mentioned that we would not be able to respond to every question you put before us. Now, with the increased volume and frequency of your questions, it has become clear that this back and forth has become a distraction from our mission work. For this reason, this will be my final response. We understand that you will continue to explore issues around Gospel for Asia and continue to be fed accusations from former employees, and we accept that.

We continue to remain accountable to all applicable laws and regulations, to the Evangelical Council for Financial Accountability and to independent auditors.

As he should be, Carroll is sad and sorry about the donors, but I still wonder when GFA is going to make a sincere effort to deal with the GFA Diaspora and other former staff.

As in previous reports, K.P. Yohannan is missing in action. No comment from him.

At the end of the article, Carroll promises to do better but he doesn’t explain why we should listen to him now. GFA touted their relationship with ECFA and their financial integrity while they were violating ECFA standards and telling people they were fine.

Some others aspects of the World article will be reviewed in a separate post (e.g., Bridge of Hope).