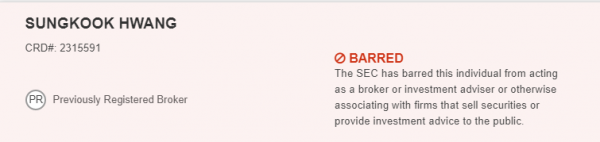

On December 1-2, Ravi Zacharias Institute will host a Business Leaders Conference in Alpharetta, GA. Participants can pay $1299 for a day and a half of talks by Zacharias, his Institute staff and invited business leaders. One of the speakers, Sungkook “Bill” Hwang runs a firm called Archegos Capital Management. However, before he founded that firm, Hwang was one of billionaire Julian Robertson’s proteges, or “tiger cubs” and founded Tiger Asia, a capital management firm specializing in Asian securities. It was there that Hwang ran afoul of the U.S. Securities and Exchange Commission and agreed to pay $44-million in order to settle charges of insider trading. He was also barred from any involvement in trading or giving investment advice for at least five years, starting 1/22/13. Hwang’s FINRA profile can be viewed at the organization’s BrokerCheck website.

According to the SEC press release about the complaint, Hwang

committed insider trading by short selling three Chinese bank stocks based on confidential information they received in private placement offerings. Hwang and his advisory firms then covered the short positions with private placement shares purchased at a significant discount to the stocks’ market price.

They separately attempted to manipulate the prices of publicly traded Chinese bank stocks in which Hwang’s hedge funds had substantial short positions by placing losing trades in an attempt to lower the price of the stocks and increase the value of the short positions. This enabled Hwang and Tiger Asia Management to illicitly collect higher management fees from investors.

In addition, criminal charges were settled against the company.

In a parallel action, the U.S. Attorney’s Office for the District of New Jersey today announced criminal charges against Tiger Asia Management.

“Hwang today learned the painful lesson that illegal offshore trading is not off-limits from U.S. law enforcement, and tomorrow’s would-be securities law violators would be well-advised to heed this warning,” said Robert Khuzami, Director of the SEC’s Division of Enforcement.

Sanjay Wadhwa, Associate Director of the SEC’s New York Regional Office and Deputy Chief of the Enforcement Division’s Market Abuse Unit, added, “Hwang betrayed his duty of confidentiality by trading ahead of the private placements, and betrayed his fiduciary obligations when he defrauded his investors by collecting fees earned from his attempted manipulation scheme.”

As the result of these actions, Tiger Asia faced opposition to continued operations in Hong Kong and Japan. The transition to Archegos appears to be in response to the demise of Tiger Asia. However, one would not know that by reading Hwang’s bio at Zacharias Institute’s Business Leaders Conference website.

Bill is the founder and Chief Executive Officer at Archegos Capital Management. Bill founded and ran Tiger Asia from 2001 to 2012, before turning the firm into a family office and renaming it Archegos Capital Management in 2013. Bill previously worked as an equity analyst at Tiger Management, as well as an institutional equity salesperson at both Peregrine Securities and Hyundai Securities.

No doubt Mr. Hwang has turned over a new leaf and it isn’t my intention to cast stones. As a significant donor to Ravi Zacharias’ ministry, I can understand why Zacharias would want to feature him at the conference. However, shouldn’t participants who are asked to pay $1299 be informed of this? At a conference on business virtue and integrity, I feel that learning from mistakes could be a valuable session. However, if these things are glossed over, what is the lesson then? By not making this a part of the conference bio, it seems like yet another effort at embellishment which Mr. Zacharias knows a lot about. He is currently in the middle of trying to explain the embellishment of his own credentials.